Over the past six years, data suggests that India’s savings rate has been consistently declining

Over the past six years, data suggests that India’s savings rate has been consistently declining

The government’s plan to gradually get rid of all exemptions and deductions under the personal income tax regime — in a bid to provide lower taxes and a simplified tax architecture as well as to boost consumption — will almost certainly hurt the already falling rate of savings rate in the Indian economy.

What’s more, several sectors such as the cash-strapped real estate sector, as well as insurance sector, are also likely to feel an adverse impact of the move in which Union Finance Minister Nirmala Sitharaman offered an alternative income tax regime bereft of all exemptions and deductions but with lower income tax rates.

The savings rate, expressed as a percentage of the gross domestic product, reflects the pool of investible funds within the country that are available for the government and private businesses to use for investment purposes. In other words, a country’s overall growth critically depends on having a healthy savings rate.

Explained

Why savings rate matters

The overall savings rate in an economy refers to the pool of domestic savings available for investment. For sustaining high growth rate (say 8%) over a long period, a country must have a high savings rate. India should ideally have close to 36%-40% (of GDP) savings rate but’s been falling over the past few years and is now 30%.

“The deductions for income tax purposes were brought in to encourage savings in the country. The idea was that these would channelise funds where they may be used for long-term projects. This new tax regime would adversely affect that intent and hurt the savings rate,” said N R Bhanumurthy, Professor, National Institute of Public Finance and Policy.

Over the past six years, data suggests that India’s savings rate has been consistently declining. At the height of India’s growth phase in 2012, the overall savings rate was around 36% but it is now down to 30%; during the 1990s, it was stuck at 23-24% of GDP.

Explained | As 15th Finance Commission report is tabled in Parliament, a look at what this body is — and what it does

“More significant is the decline in household savings. They were 23% in 2012 and by 2018, just 17%,” says Sunil Sinha, principal economist of India Ratings. This is crucial because of the four categories of savers in the economy — namely the government, the public sector, the private corporate sector and the household sector — it is the household sector which actually saves; the other three are dis-savers in aggregate.

The household sector refers to not only average families but also unregistered firms — kirana shops, for example — in the informal sector.

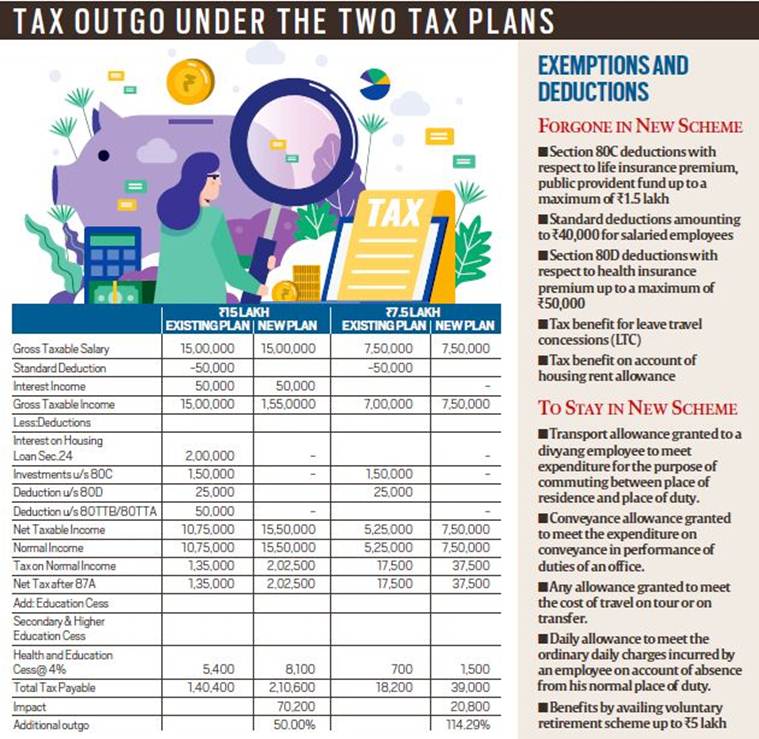

Tax outgo under the two plans

Tax outgo under the two plans

Behind new Income Tax regime: 92% used exemption under Rs 2 lakh

What’s more, the “financial” savings of the households, as against savings in the form of physical assets such as gold, are not enough to even cover the government’s borrowings (both on and off the books).

“That is why the interest rates are not falling in the country and businesses are stuck with a double whammy — that is, at a time when the demand is low, the cost of investment is also high — thus making us uncompetitive,” said Sinha.Bhanumurthy said that, given the falling trend of savings rate, he was expecting the government to launch tax-free infrastructure bonds to raise the level of savings.

Explained | Why Budget proposal on tax on Indians working abroad triggered confusion

Most Read 1Kolkata or Mumbai, where will India play their World Cup semifinal? Depends on who they face 2Aamir Khan charged Rs 25 lakh for a commercial, Shah Rukh Khan was ready to do it for Rs 6 lakh as he wanted to buy Mannat: Prahlad Kakkar 3Cricket World Cup: No feet, no lower body power, all hands – how Glenn Maxwell smashed the greatest ODI knock of all time 4Vaibhavi Merchant says Amitabh was ‘encouraging’ while shooting Kajra Re with Aishwarya, Abhishek; asking Gulzar to simplify lyrics 5Leo box office collection day 20: Vijay starrer soldiers on but unlikely to go past Rajinikanth’s Jailer record

“If we assume an Incremental Capital Output Ratio of 4, India needs a savings rate of at least 32% to grow at 8%. If you assume an ICOR of 5, the savings rate required for 8% growth will be 40%,” he points out. The ICOR essentially maps the efficiency of capital and show how many units of capital (investment or savings) are required for getting an additional unit of economic growth.

Of course, one can borrow from outside India but it is not advisable to depend on too much foreign borrowings because such borrowings show up in higher current account deficit, which, in turn, will put pressure on the domestic currency, raise the crude oil bill and fuel inflation inside the country.

Also ReadTotal outlay for healthcare rises, but fall in capexUnion Budget 2023 income tax slabs: New tax regime is default, rebate inc…Union Budget 2023-24: Education outlay hiked 8%, PM-Poshan gets 13% moreBudget 2023: Smoking to be costlier, custom duty on cigarettes increased

📢 The Indian Express is now on Telegram. Click here to join our channel (@indianexpress) and stay updated with the latest headlines