Presenting the last full-fledged budget of the second term of Narendra Modi-led government, Union Finance Minister Nirmala Sitharaman on Wednesday announced that the new tax regime will now be the default tax regime.

The FM also announced an increase in the income tax rebate limit from Rs 5 lakh to Rs 7 lakh under the new tax regime. “Currently, those with an income of Rs 5 lakh do not pay any income tax and I propose to increase the rebate limit to Rs 7 lakh in the new tax regime,” the Finance Minister said while presenting the Budget.

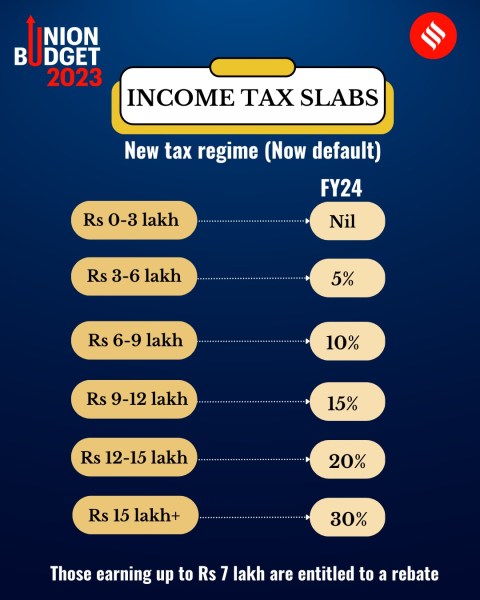

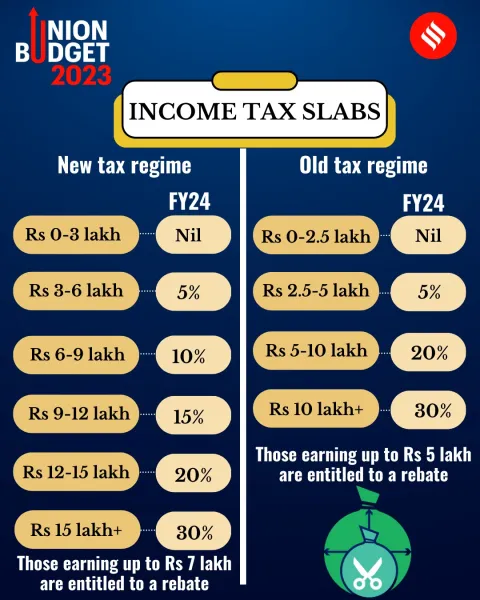

While a five per cent tax will be levied on total income between Rs 3 lakh and Rs 6 lakh, 10 per cent will be levied on Rs 6 lakh to Rs 9 lakh, 15 per cent on Rs 9 lakh to Rs 12 lakh, 20 per cent on Rs 12 lakh to Rs 15 lakh and 30 per cent on Rs 15 lakh and above.

Here are the revised tax slabs under new tax regime

🔴 Income of Rs 0-3 lakh is nil.

🔴 Income above Rs 3 lakh and up to Rs 6 lakh to be taxed at 5% under new regime.

🔴 Income of above Rs 6 lakh and up to Rs 9 lakh to be taxed at 10% under new regime.

🔴 Income above Rs 12 lakh and up to Rs 15 lakh to be taxed at 20% under new regime.

🔴 Income above Rs 15 lakh to be taxed at Rs 30%.

The government, meanwhile, also proposed to reduce highest surcharge rate from 37 per cent to 25 per cent in new tax regime.

Use this tool to check your taxes

While explaining the new tax regime, Finance Minister Nirmala Sitharaman also spoke about the losses the Centre would undertake for facilitating it. “India will lose Rs 35,000 crore of net tax revenue to provide relief to the middle-income group. “Revenue of about Rs 38,000 crore — Rs. 37,000 crore in direct taxes and Rs 1,000 crore in indirect taxes — will be forgone while revenue of about Rs 3,000 crore will be additionally mobilized. Thus, the total revenue forgone is about Rs 35,000 crore annually,” she said.

The FM also allowed a Rs 50,000 standard deduction to taxpayers under the new regime, where assessees cannot claim deductions or exemptions on their investments.

It may be recalled that the Finance Minister did not announce any change in income tax slabs in the last Budget.

Meanwhile, the FM had, last month, defended the new income tax regime saying it had not reversed any gains from the old regime’s simplicity. “If indeed there were gains of simplicity (from the old income tax regime), I want to assure they have not been reversed,” Sitharaman said in New Delhi. “For every tax assessee, it has 7, 8, 9, 10 exemptions. And with all that exemptions, the rate 10, 20, 30 per cent continues. It continues even today. We have not removed it. What we have done in the name of simplicity and to avoid harassment… removing harassment was what was aimed at when we brought in faceless tax assessment,” she added.

Don't miss | Union Budget: Tweak in income slab rates expected

The government in Budget 2020-21 brought in an optional income tax regime, under which individuals and Hindu Undivided Families (HUFs) were to be taxed at lower rates if they did not avail specified exemptions and deductions, like house rent allowance (HRA), interest on home loan, investments made under Section 80C, 80D and 80CCD. Under this, total income up to Rs 2.5 lakh was tax exempt.

Currently, a 5 per cent tax is levied on total income between Rs 2.5 lakh and Rs 5 lakh, 10 per cent on Rs 5 lakh to Rs 7.5 lakh, 15 per cent on Rs 7.5 lakh to Rs 10 lakh, 20 per cent on Rs 10 lakh to Rs 12.5 lakh, 25 per cent on Rs 12.5 lakh to Rs 15 lakh, and 30 per cent on above Rs 15 lakh.

Most Read 1As Indo-Canadian relations sour, anxiety grips Indian students, residents who wish to settle in Canada 2Farida Jalal recalls the time when Amitabh Bachchan-Jaya Bachchan were dating: ‘They would pick me up at night, we would go for long drives’ 3Jawan box office collection day 12: Shah Rukh Khan’s blockbuster nears Rs 900 crore gross worldwide 4Jawan star Shah Rukh Khan set to become the only Indian actor to have two Rs 1,000-crore grossers in one year 5Gadar 2 box office collection day 39: Sunny Deol movie is on its last legs

The scheme, however, has not gained traction as in several cases it resulted in higher tax burden.

With effect from April 1, these slabs will be modified as per the Budget announcement.

Union Budget 2023: All you need to know

Also ReadUnion Budget 2023: Rs 990 crore allocated for G20 presidencyUnion Budget 2023-24: Education outlay hiked 8%, PM-Poshan gets 13% moreBudget 2022: Rs 200 cr for development assistance to Afghanistan, Rs 100 …FM radio industry has flourished, 388 private stations in 2022 June quart…↗️ Finance Minister Nirmala Sitharaman’s Union Budget 2023 has some big takeaways↗️ First, what everyone has been looking forward to: changes in the new income tax regime. She has made the new tax regime more attractive. There are changes in the rebate limit and in tax slabs. What does this mean for the taxpayer?↗️ FM Sitharaman proposed a 33% increase in capital investment outlay, raising it to Rs 10 lakh crore. This is the biggest in the past decade. What does it mean?↗️ Some articles get cheaper and others get costlier due to changes in customs duty. Here is a list↗️ The capital outlay for the railways has been increased to the highest ever – Rs 2.40 lakh crore. The government is trying to create more jobs↗️ FM Sitharaman said the fiscal deficit will fall to 5.9% of the GDP. What does it mean for the stakeholders?↗️ The FM called it the ‘first Budget of Amrit Kaal’. PM Narendra Modi said it will build a strong foundation for a developed India. What did opposition leaders say?

(With inputs from PTI)

© IE Online Media Services Pvt Ltd