Dear Readers,

As India celebrates its 77th Independence Day, it is natural to reflect on how far we have come as a country. Last week, India’s central bank released a set of survey results — it does these surveys every couple of months — that show how the perception of Indians about their own well-being and the state of the economy changed over time.

The survey in question is called the Consumer Confidence Survey (CCS). According to the RBI, the latest round of the survey was conducted during July 1-10, 2023, and it covered 6,047 respondents (with over 50% of them being women) spread across 19 major cities of India.

During the survey, RBI asks respondents about five key variables, namely the general economic situation, employment scenario, overall price situation, own income and spending. In each case, it asks respondents how the situation has changed in comparison to the situation a year ago.

On each factor, the RBI asks respondents to answer whether they think things have improved or worsened or remained the same. It then looks at the difference between the percentage of respondents who found that things improved and those who felt that things had worsened. This difference is called the “net response”, and it provides a summary measure of the prevailing sentiment.

For instance, if 70% of the people said the economy had improved from a year ago, 10% said it was the same as last year and the remaining 20% said that it had become worse, then the net response would be 50% (that is, 70% minus 20%). If, on the other hand, 70% felt that the economy had worsened and 20% said it felt better, then the net response would be a negative 50%.

The Charts below map out the historical trend of all three responses as well as the “net response” number. If the net response number is negative, then it means the overall sentiment is in the negative zone. However, as some of the charts will show, it is possible that the sentiment improves but not enough to come out of the negative zone.

The results of these surveys are interesting because the data series for most goes back over a decade and, as such, provides a good picture of how the perception of Indians about the state of the economy changed over this period.

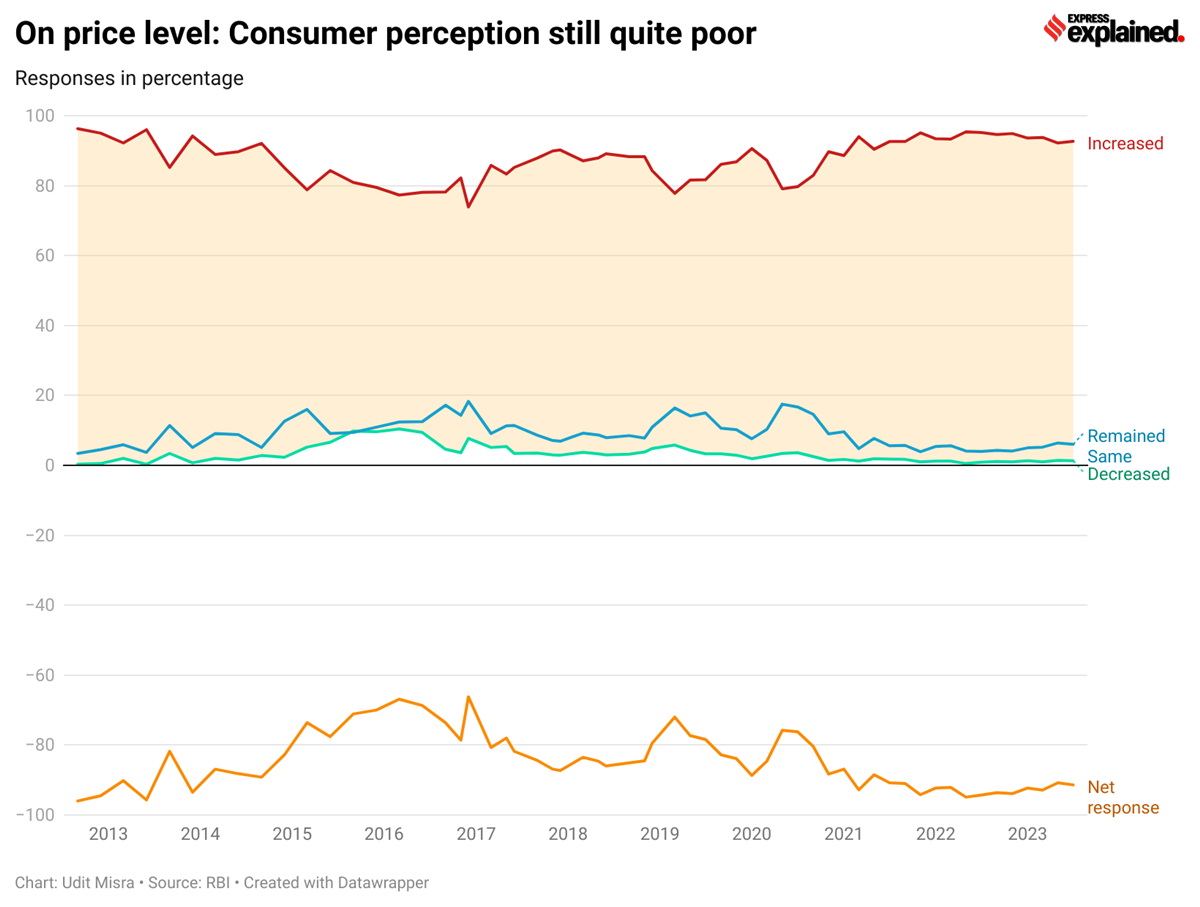

#1: Price level

Let’s start by looking at the consumer sentiment around the general price level since retail inflation rose by 7.5% in July, yet again breaching the RBI’s comfort zone of 2% to 6%.

This is reflected in CHART 1. The net responses percentage (orange line) worsened in July.

Chart 1:

Chart 1:

But CHART 1 also shows that net responses have been in the negative zone — and that too around minus 90% for a long time. That is because the percentage of respondents who felt prices have gone up (as compared to last year) — shown here by the red line — has always been quite high. It shows that Indians have been suffering high prices for a long time now. There were some periods of respite (that is, when the net responses became less negative) such as 2016 but for the most part, the broader consumer sentiment has been overwhelmingly negative when it comes to prices.

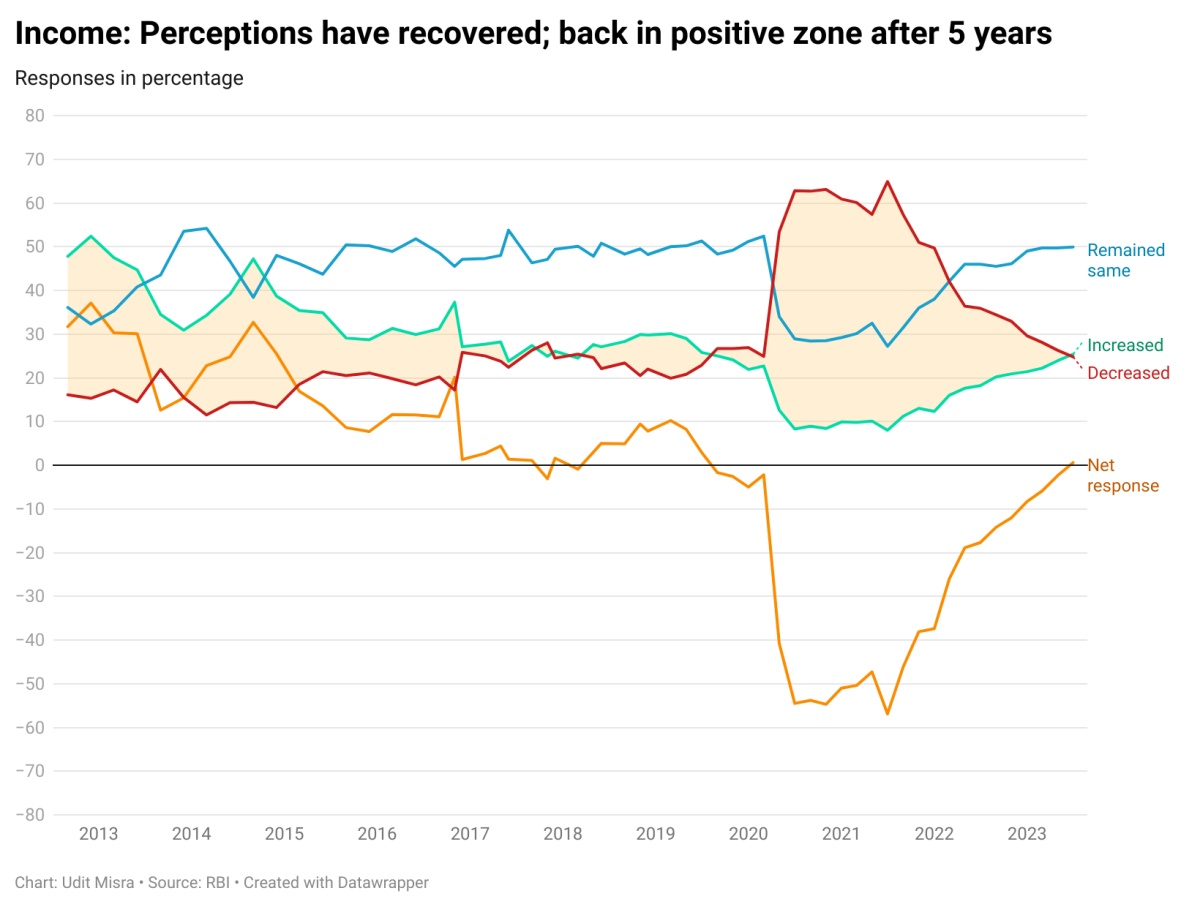

#2: Income

CHART 2 shows how the perceptions have changed when it comes to income levels. The July survey shows that net responses (orange line) are back in the positive territory after 5 years.

Chart 2:

Chart 2:

That means the percentage of respondents who felt their incomes had improved (as compared to a year ago) was just a shade more than the percentage of people who felt their incomes had gone down.

However, over a longer term, CHART 2 shows that perceptions around incomes have worsened considerably from the 2013 (or even 2015) levels. The trajectory of the green line shows that far fewer people report experiencing improved income levels.

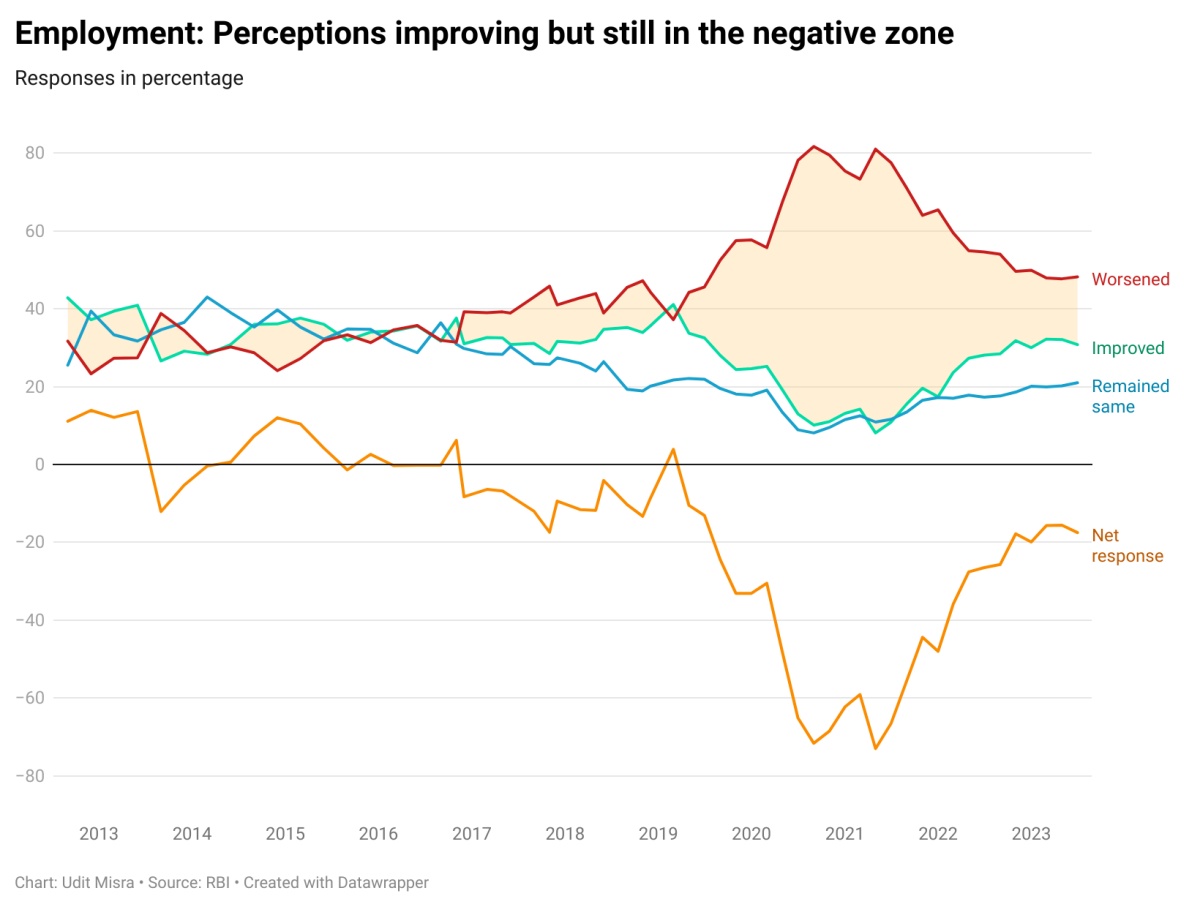

#3: Employment

Data on employment has been a cause of a lot of controversy. But CHART 3 shows that the public perception is still quite negative by recent historic standards.

Chart 3:

Chart 3:

The red line maps the percentage of people saying that employment levels are worse than what they were a year ago. Even though this line has come off the boil, it is still at a relatively high level.

This results in the net responses (orange line) still languishing in the negative zone — still below the pre-Covid levels, notwithstanding the recent recovery.

Much like the chart on income, here, too, the net responses were far below the level recorded a decade ago.

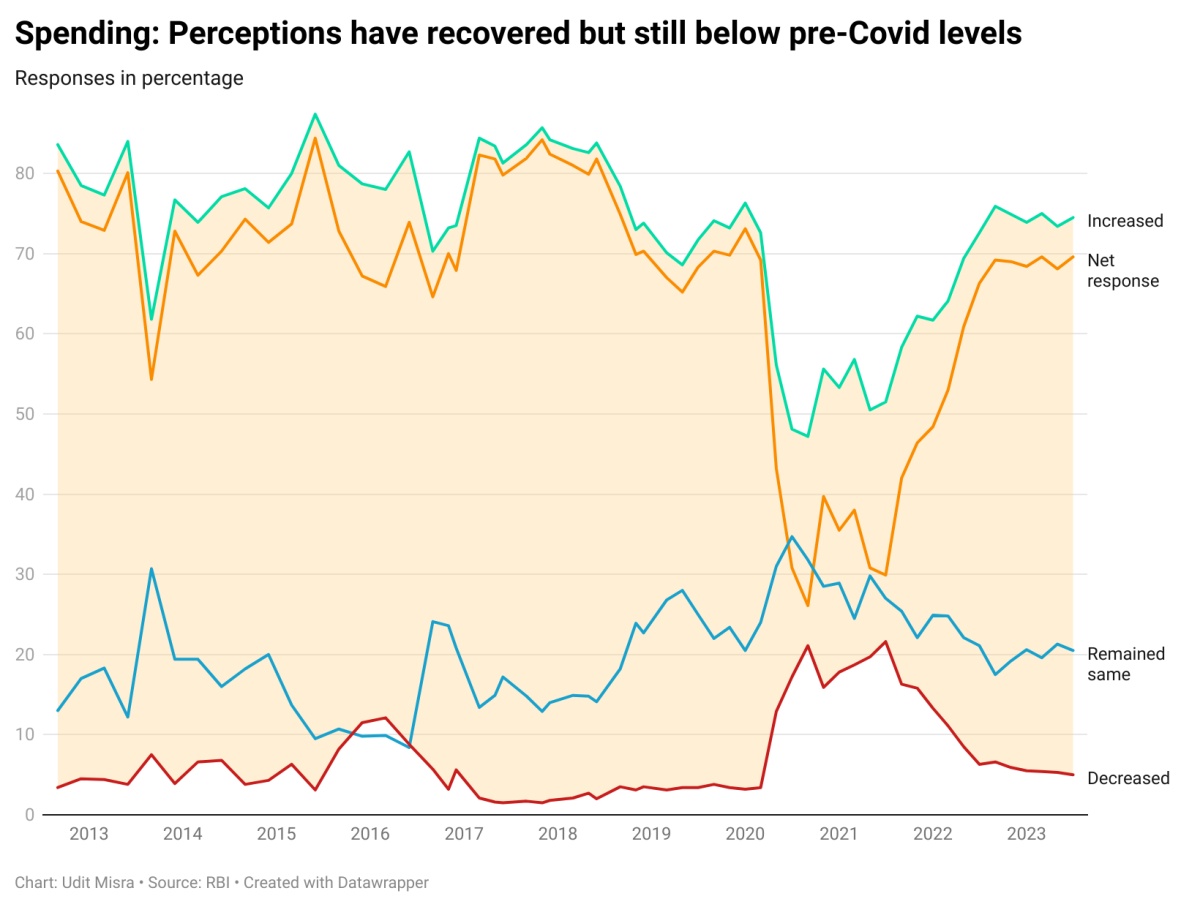

#4: Spending

CHART 4, which refers to questions about spending, is unlike any other in this series because it is the only one where the orange line of net response has not gone into negative territory. In other words, the percentage of people saying their spending increased (from a year ago) has always been far more than the percentage of people who said their spending decreased (from a year ago).

Chart 4:

Chart 4:

To be sure, it is a good sign that net responses are in positive territory. It shows that overall people believe they are spending more than what they were a year ago. This expenditure fuels the economy.

However, the current levels are still lower than the levels recorded in 2018. Readers will recall that the Indian economy lost its growth momentum quite rapidly during 2018 and 2019.

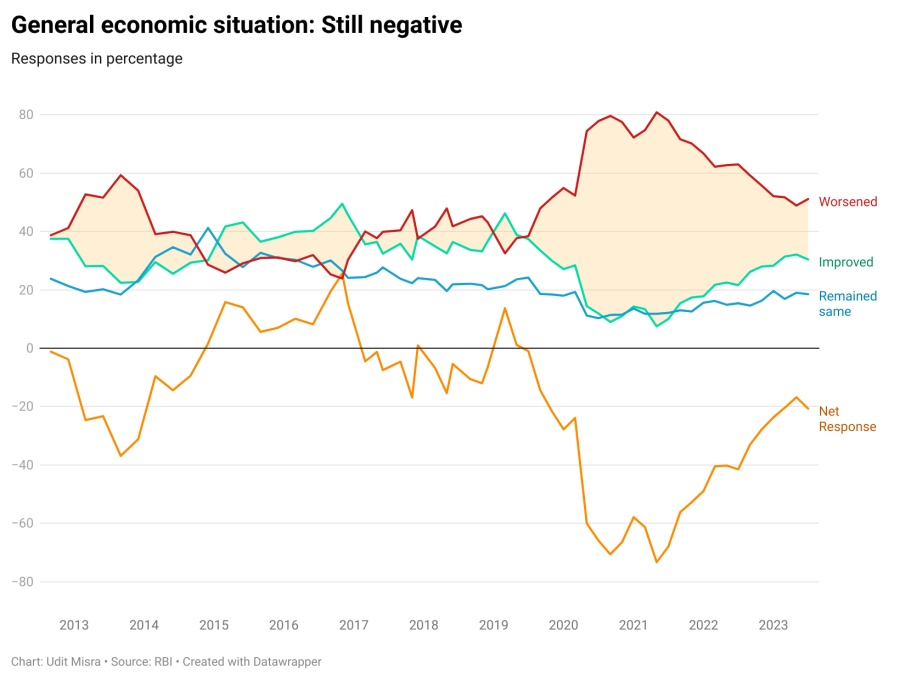

#5: General Economic Situation

Chart 5:

Chart 5:

As the orange line of net responses in CHART 5 shows, Indians had a negative impression of the state of the economy in 2012. That sentiment just kept getting worse (look at the red line) until a new government under Prime Minister Narendra Modi took charge in 2014.

Over the next three years, the sentiment improved steadily (orange line). However, since then, it has broadly worsened. The Covid pandemic simply made matters worse, and even though the aggregate sentiment has improved a fair bit, it is still significantly in the negative zone. In July, for instance, 51.1% of the respondents said that the general economic situation had worsened (when compared to a year ago) while only 30.4% of the respondents said that it had improved. That pegs the net response at minus 20.7% — reminiscent of March 2013 levels.

Upshot

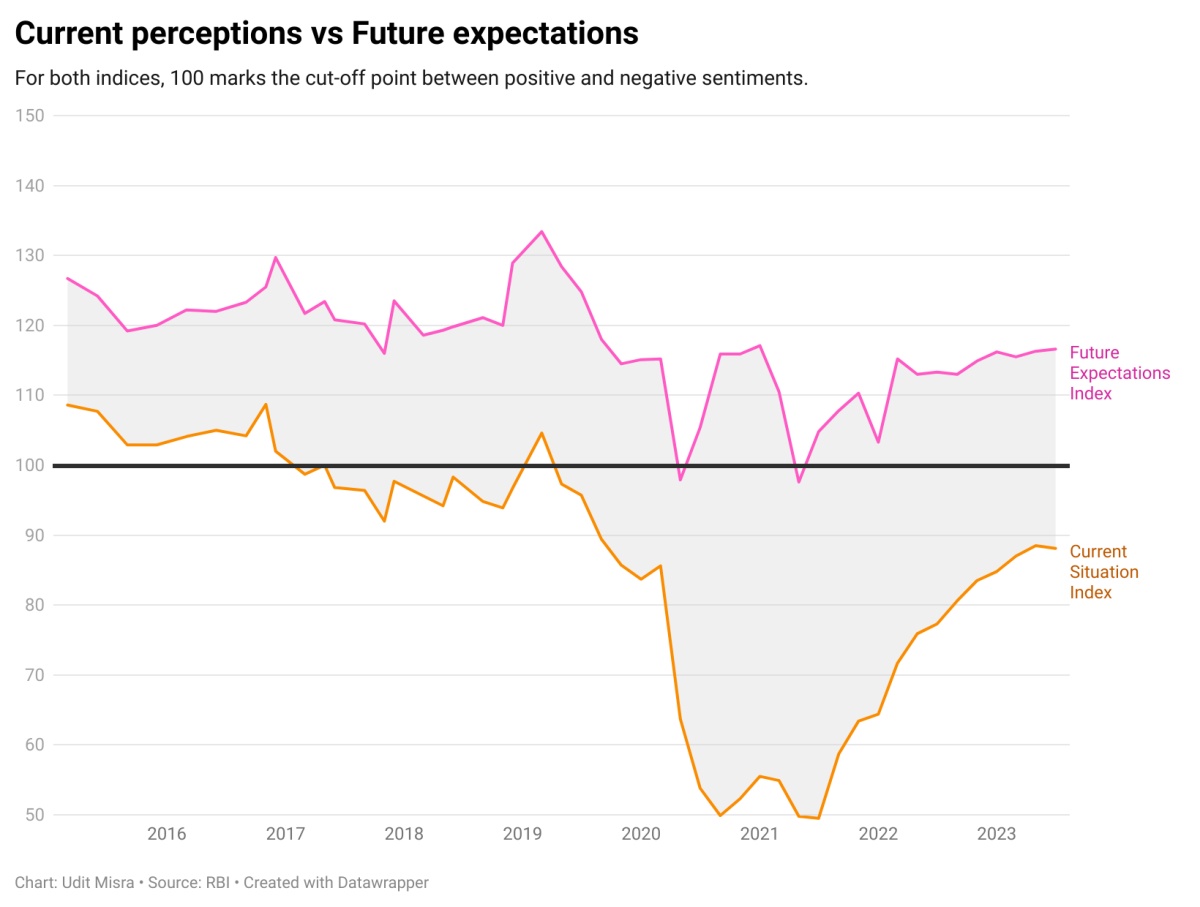

Based on individual responses to these queries, the RBI also constructs a couple of indices to capture the overall sentiment. These are called the Current Situation Index (which maps how perceptions are relative to a year ago) and the Future Expectation Index (which maps how people expect things to be on each of these variables a year from now).

Most Read 1Chandrayaan-3 mission: Dawn breaks on Moon, all eyes on lander, rover to wake up 2As Indo-Canadian relations sour, anxiety grips Indian students, residents who wish to settle in Canada 3Karan Johar says Sanjay Leela Bhansali did not call him after Rocky Aur Rani: ‘He’s never called me but…’ 4Gadar 2 box office collection day 40: Hit by Shah Rukh Khan’s Jawan onslaught, Sunny Deol movie ends BO run with Rs 45 lakh earning 5Shubh’s tour in India cancelled: Why is the Canada-based singer facing the music?

CHART 6 maps both these indices. The cut-off point in this chart is 100: An index value more than 100 is considered positive while an index value less than 100 is negative. It is also noteworthy that the data for these indices goes back only up to 2015.

Chart 6:

Chart 6:

As one can see, both indices have been recovering ground after the massive dip due to the Covid pandemic. Notwithstanding this improvement, public perception about the state of the economy has been in the negative territory since the start of 2019 (pre-Covid) — closely coinciding with the second term of PM Modi-led government. Similarly, as things stand, the index value of future expectations is also half of what it was at the start of 2019.

Also ReadSensex, Nifty dip by 1%: What has triggered this sell-off?Bima Sugam: Is it a ‘UPI moment’ for insurance sector, and how will it be…EV subsidies: Will EU-China row lead to a tariffs war?How Basmati in India is reaping the rewards of research

Share your views and queries at udit.misra@expressindia.com

Until next time,

Udit