Dear Readers,

[Instead of focussing on a single topic, this week ExplainSpeaking will tackle several different albeit interrelated topics. Please share your views about this format in the email given below.]

Prime Minister Narendra Modi has successfully turned the routine rotational presidency of the G20 into an event to showcase India’s growing economic might. However, domestically, data suggests that consumer sentiment has taken a beating over the past month.

The timing could not be worse since India is just starting its annual festive season — the period when the economy often witnesses a surge in shopping.

What has not taken a beating is retail inflation. All evidence points to the fact that August’s retail inflation — which will be announced Tuesday evening — will again be over 7%.

Lastly, moving away from these very short-term developments, a new research paper has found some rather humbling projections for India’s GDP growth rate over the coming decade.

Consumer Sentiments Drop

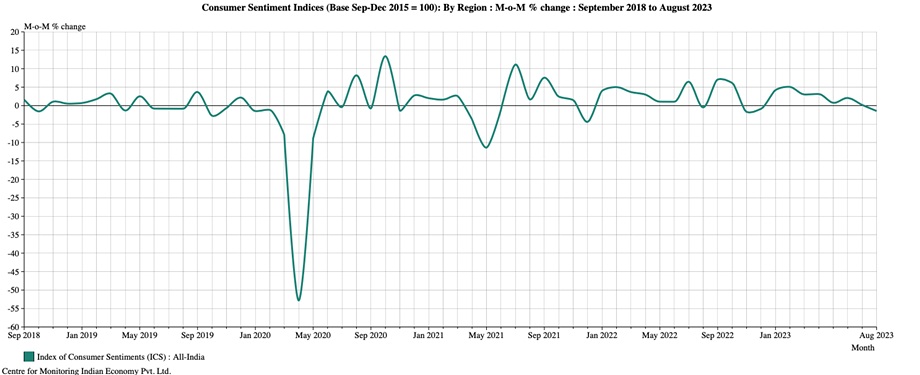

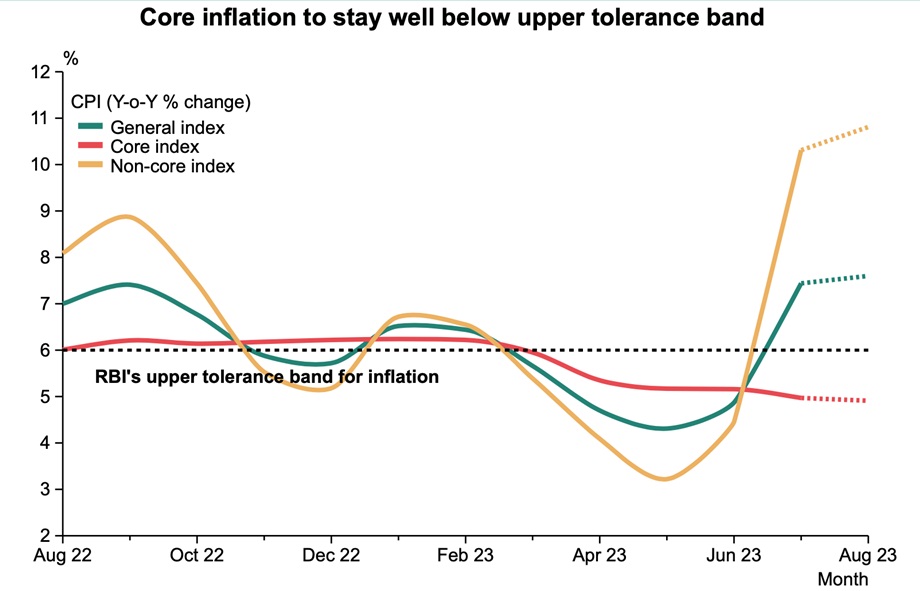

According to the Centre for Monitoring Indian Economy’s (CMIE) Economic Outlook, consumer sentiments fell by 1.5 per cent in August 2023 (see CHART 1). Consumer sentiments were rising every month since January 2023. The average monthly growth in consumer sentiments in India during the January-July months of 2023 was 2.6 per cent.

CHART 1.

CHART 1.

To be sure, this drop in sentiments is not just of academic significance; it can have a real impact on the economy and Indian businesses who are gearing up for making the best sales of the year in the forthcoming festive season. That’s because one of the key constituents of CMIE’s consumer sentiments index is the consumers’ intention to buy consumer durables (read cars, TVs and other home appliances).

Data shows that a big reason why the consumer sentiments index fell is the significant drop in consumers’ intention to buy such items. Look at CHART 2. The green line maps the all India intention to buy consumer durables and it dipped in August. The yellow line maps the same sentiment for rural consumers and it has been negative for the past three months. That shows that sentiments are significantly worse in rural India.

CHART 2.

CHART 2.

What’s triggering this turnaround in sentiments?

According to Mahesh Vyas, the CEO of CMIE, family incomes are facing headwinds.

“The proportion of households who said that their incomes were higher than a year ago was rising steadily and steeply between December 2022 (when it was 17.4 per cent) and April 2023 (when it had risen to 30.2 per cent). Then, the growth in this proportion stalled at around 30 per cent for five months till August 2023. Such stagnation has not been seen any time earlier in the past two years, which is the post- pandemic recovery period,” states Vyas in a research note. For perspective, it is noteworthy that before the Covid pandemic, between 32 and 36 per cent of the respondents said that their incomes were higher than they were a year ago.

But it is not just the stagnation in perceived incomes that may be dragging sentiments. Vyas finds that there’s also been a rise in pessimism regarding future incomes.

“The proportion of households that said that they expect their household income to rise a year into the future fell from 25.6 per cent in July 2023 to 23.7 per cent in August; this is the lowest proportion since March 2023. Further, the proportion that said that they expected their incomes to fall a year later rose from 15.3 per cent to 17.7 per cent, which is also the highest in the last three months,” he states.

Best of ExplainedWomen's reservation: Seeds of the idea under Rajiv Gandhi and Narasimha Rao govtsWho was Hardeep Singh Nijjar, the Khalistani separatist that Canada PM Trudeau says India may have got killedBima Sugam: Is it a ‘UPI moment’ for insurance sector, and how will it benefit customers?Click here for more

Inflation expected to stay high

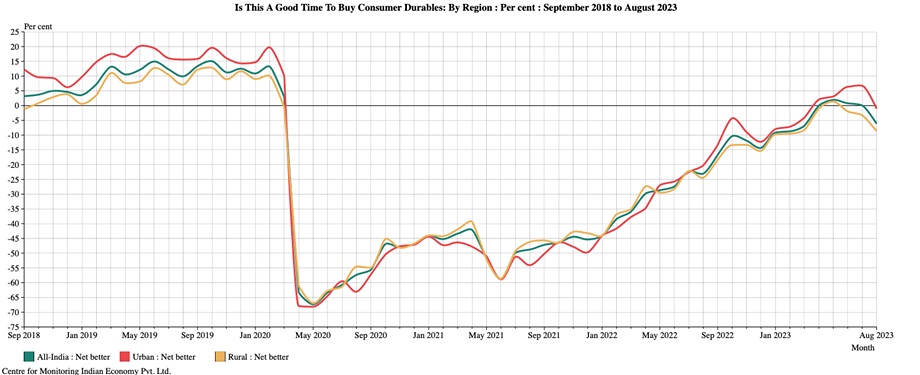

What does not help consumer sentiments, especially when the outlook on incomes is turning weaker, is sustained high levels of consumer inflation.

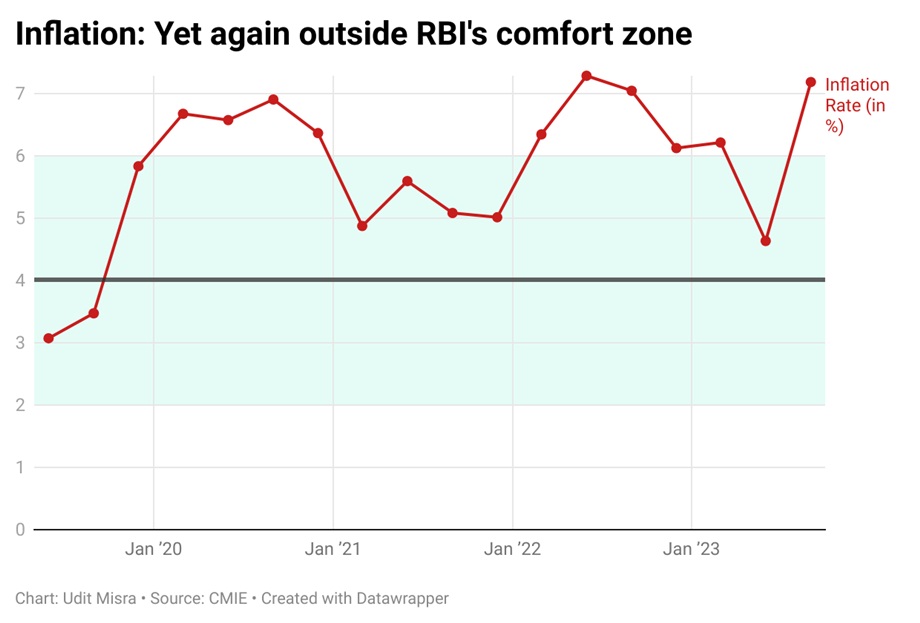

CMIE expects retail inflation for August — which will be announced on Tuesday evening — to be above 7%. This means, India’s general price level in August would be 7% higher than August last year. To be sure, the RBI ( India’s central bank) is supposed to ensure that retail inflation stays as close to 4% as possible with a comfort zone of 2% to 6%. At 7%, retail inflation will again be outside RBI’s comfort zone. (See CHART 3 ;green line).

CHART 3.

CHART 3.

What is worse is that the current trend of high inflation will drag the overall consumer inflation for the second quarter (July, August and September) outside RBI’s comfort zone yet again (see CHART 4, which maps average inflation in each quarter since the start of 2019 financial year).

CHART 4.

CHART 4.

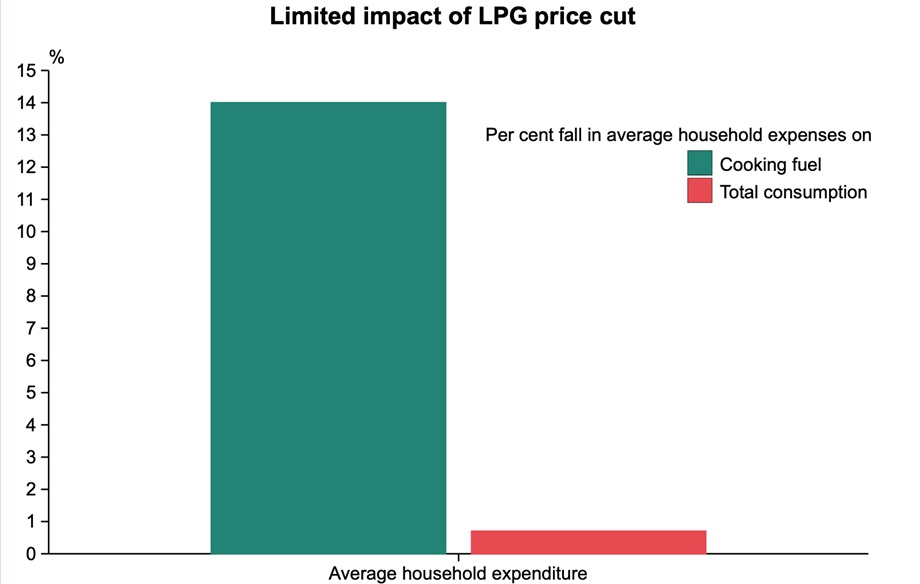

A related question could be: How far did the government’s recent cut in LPG prices help the family budgets?

The Central government announced a cut in cooking gas price across all markets by Rs 200 per cylinder with effect from 30 August 2023. This will benefit all the 330 million domestic LPG consumers in India; 103.5 million of whom are beneficiaries under the government’s promotional scheme — the Pradhan Mantri Ujjwala Yojana (PMUY).

According to CMIE’s Consumer Pyramids Household Survey, in 2022-23, on average Indian families spent Rs 8,500 on cooking fuel. To be sure, the Rs 8,500 assumes the annual use of 6 LPG cylinders on an average.

So as a proportion of the expenditure on cooking fuel, the cut is expected to bring a relief of 14% (see CHART 5).

CHART 5.

CHART 5.

However, according to CMIE, expenditure on cooking fuels accounts for only 4.8 per cent of total households consumption expenses. As such, the net impact of the LPG price cut on average family budgets was less than 1% (0.7% to be precise).

India’s GDP growth outlook: Back to the Hindu rate?

Lastly, while it is true that India’s growth rate is the envy of the developed world, the fact is there are considerable challenges before India. Already — and ExplainSpeaking has written extensively about this issue in the past — India’s potential GDP growth rate has steadily come down from around 8% just before the Global Financial Crisis of 2008-09 to just 6% before the Covid pandemic. To be sure, the potential GDP growth rate of an economy is the rate at which its GDP can grow without causing high inflation.

In ExplainSpeaking | Is India reverting to the Hindu rate of growth?

The bump in India’s GDP growth rates immediately after the pandemic hit year of 2020-21 is, to a great extent, illusory because these high rates are coming because of a lower base. For understanding, note that when 100 falls by 25%, a 25% increase only comes up to 93.75 — that’s more than 6% below the original number.

Over the medium-to-long term, India’s GDP growth is facing all kinds of headwinds such as a slowing global economy, high oil prices and climate change to name a few. Different economists are trying to figure out what is likely to be India’s average growth rate over the coming decade.

In this regard, a new research paper by three economists — led by Dibyendu Maiti of the Delhi School of Economics — has projected a sobering picture. According to them, “the Indian economy cannot grow more than 5% over the coming decade in a business-as-usual scenario”.

Most Read 1Chandrayaan-3 mission: Dawn breaks on Moon, all eyes on lander, rover to wake up 2As Indo-Canadian relations sour, anxiety grips Indian students, residents who wish to settle in Canada 3Karan Johar says Sanjay Leela Bhansali did not call him after Rocky Aur Rani: ‘He’s never called me but…’ 4Gadar 2 box office collection day 40: Hit by Shah Rukh Khan’s Jawan onslaught, Sunny Deol movie ends BO run with Rs 45 lakh earning 5Shubh’s tour in India cancelled: Why is the Canada-based singer facing the music?

“While most scholars and planners have been optimistic about the growth acceleration of the Indian economy, especially after the global financial crisis and Covid-19 pandemic shocks, there is reason to be cautious about supporting this. Before the pandemic, the economy was already crippled by a real sector crisis: a significant surge of non-performing assets in the financial sector, rising petroleum prices, and a huge unemployment problem. The lower repo rate and higher budget deficits have further squeezed the capacity to exercise expansionary fiscal and monetary policies to deal with these issues,” they write in a recent note on the “Ideas For India” portal.

While a growth rate of 4% to 5% will still be attractive from a global perspective, the fact is, it is most unlikely to be sufficient from the domestic perspective where millions upon millions of young Indians need jobs.

Also ReadSensex, Nifty dip by 1%: What has triggered this sell-off?Bima Sugam: Is it a ‘UPI moment’ for insurance sector, and how will it be…EV subsidies: Will EU-China row lead to a tariffs war?How Basmati in India is reaping the rewards of research

Share your views about this new format of ExplainSpeaking as well as on the different topics covered at udit.misra@expressindia.com

Until next time,

Udit