These are two decades old, met regulatory norms: Panda (Express photo by Praveen Khanna)

These are two decades old, met regulatory norms: Panda (Express photo by Praveen Khanna)

The Income Tax department has received a complaint alleging money laundering and tax evasion by former Biju Janata Dal MP and Odisha industrialist Baijayant Jay Panda, his wife and associates.

The complaint received in January claimed that Panda, his wife Jagi Mangat Panda and “their close associate” Manjula Devi Shroff “committed offences under the Prevention of Money Laundering Act, the Black Money Act, the Income-Tax Act etc by using shell companies” to bring in at least Rs 17.72 crore “without any known source from outside India” and then transfer the “shares obtained in lieu of these foreign investments to entities held by Panda and his wife at negligible price.”

When contacted, Baijayant Panda and Manjula Devi Shroff denied any wrongdoing. In an email, Panda said, “The transactions you refer to include those which are well over two decades old. To the best of my knowledge, they met the prevailing regulatory norms and had the requisite approvals.” Shroff said, “As a power of attorney holder, I have had no control over the entities that you mention nor have I been the beneficiary of any of the transactions.”

The companies, Finlay Corporation Limited, Messina Corporation Limited and Pikika Limited, were incorporated in the Caribbean tax haven figured in the Bahamas Leaks expose reported by The Indian Express with the International Consortium of Investigative Journalists (ICIJ) in 2016.

According to the records of the Bahamas registrar of companies, Finlay, Messina and Pikika were incorporated in June 1993, January 1995 and March 2003 respectively by agent Corporate Services International Limited at the same address in Nassau, Bahamas, with proxy office bearers.

Records show that Manjula Devi Shroff, identified at her Delhi address, held the power of attorney for Finlay and Messina since July 1994 and January 1995, respectively. From an erstwhile royal family of Odisha, Manjula Devi Shroff is CEO of Kalorex Group that runs schools in Gujarat. She is on the board of Kishangarh Environmental Development Action Pvt Ltd and Odisha Television Ltd along with Jagi Mangat Panda.

She was also a director, along with Baijayant Panda and Jagi Mangat Panda, of Ortel Communication Limited, a regional cable and broadband services provider, from 1998 till 2013. The company is currently under the corporate insolvency resolution process.

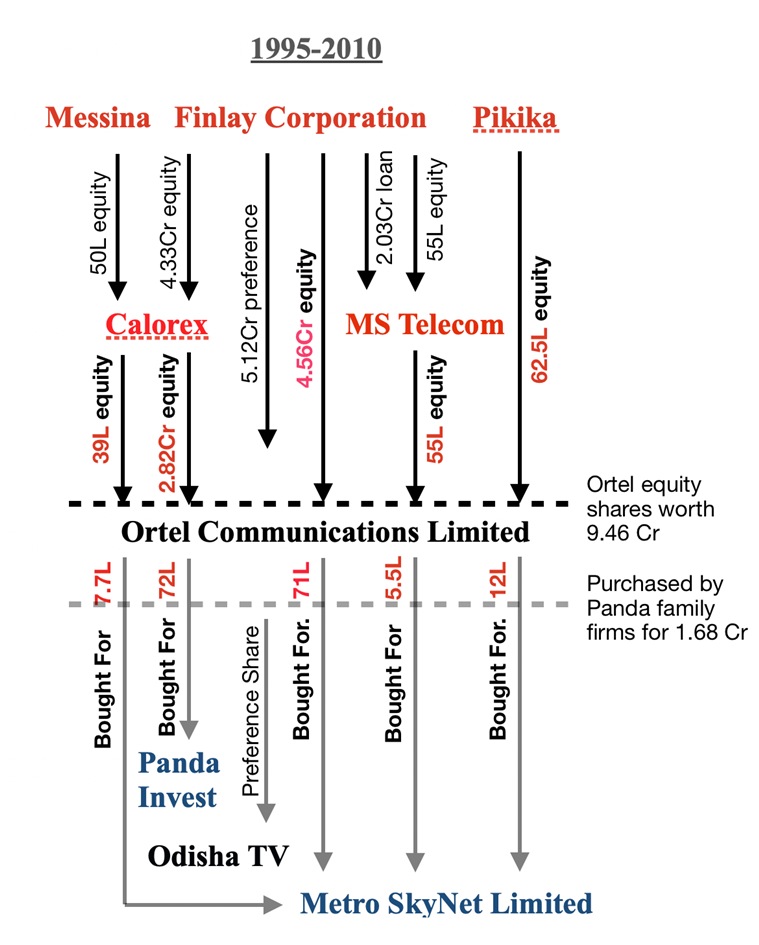

Between 1995 and 2007, the three Bahamas companies Finlay, Messina and Pikika invested – directly and through their India subsidiaries MS Telecom Ltd and Calorex Holdings Private Ltd – in Ortel a total of Rs 17.72 crore not only in equity but also in preference shares and by extending loans. Manjula Devi Shroff was a director in both MS Telecom and Calorex.

The Panda family picked up the Ortel equity shares acquired for Rs 9.46 crore by the three Bahamas entities and their two Indian subsidiaries through the family-owed Panda Investments Private Limited and Metro Skynet Limited at almost one-sixth the cost of acquisition for Rs 1.68 crore in cash.

Further, all preference shares held by Finlay were allotted in December 2010 to Odisha Television Limited where Manjula Devi Shroff and Jagi Mangat Panda are directors.

Pikika was dissolved in July 2011 and Messina in February 2013. Finlay folded up in March 2018. and yet the company’s 96.13% shareholding in and the Rs 2.03 crore loan it advanced to MS Telecom appeared in the latter’s 2017-18 annual return.

THE TRANSACTION DETAILS

Ortel Communications Limited entered the cable TV business in 1995. One of the earliest private Internet service providers, it obtained ISP licence in 1998. The company’s IPO was under-subscribed in 2015. The National Company Law Tribunal ordered Commencement of Insolvency Resolution Process for Ortel in November 2018 after Sony Pictures Network India, an operational creditor, moved the Tribunal.

According to the 2011 Red Herring Prospectus filed by Ortel Communications with the Securities & Exchange Board of India (SEBI), Finlay made eight investments amounting to Rs 9.68 crore in Ortel Communications Limited between 1995 and 2007.

Finlay also invested Rs 4.33 crore in Calorex Holdings Private Limited, a company where Manjula Devi Shroff served as director since 1995. Calorex in turn invested Rs 2.82 crore in Ortel.

Finlay further invested Rs 55 lakh in and loaned another Rs 2.03 crore to MS Telecom Investments Private Limited where Manjula Devi Shroff was both director and shareholder. MS Telecom, in turn, invested Rs 55 lakh in Ortel.

Messina invested Rs 50 lakh in Calorex which acquired Ortel shares for Rs 39.45 lakhs and Pikika directly picked up stake in Ortel worth Rs 62.5 lakh.

In all, the three Bahamas shell entities brought in Rs 17.72 crore to companies linked to the Pandas and Shroff.

Then, show Ortel’s 2011 Red Herring Prospectus, in September 1999, Panda Investments acquired all 28,18,000 Ortel shares held by Calorex at Rs 2.55 per share. In May 2010, Metro Skynet purchased a total of 48,59,512 shares of Ortel from MS Telecom, Calorex, Finlay and Pikika at just Rs 1.95 per share. This, when Panda and the companies he controlled acquired Ortel shares from third parties at Rs 79 per share in April 2010.

All 51,21,897 preference shares of Ortel held by Finlay were to be converted/ redeemed on December 29, 2010. On that day, the shares were allotted to Odisha Television Limited where Manjula Devi Shroff and Jagi Mangat Panda are directors.

The transaction details

The transaction details

FULL RESPONSE OF BAIJAYANT PANDA

“I am shocked and dismayed at the allegations against my family and me that you have mentioned in your email, but no longer surprised. Though you have not indicated who has made these allegations, it has become a ritual for many years now that, just before every election cycle, or when I have taken a particular stand that goes against certain vested interests, such allegations are routinely brought against me. For years, I have refuted all such earlier attempts to malign my reputation, through a comprehensive disclaimer posted on my website.

In this instance, too, I strongly deny the allegations. I come from a business family that has a 60 year track record of building and operating private and public companies that have employed many thousands in India and have legitimate transactions around the world. The company you have referred to, Ortel, is one such, with a 25 year history. It has been a pioneer in its field, having been in the 1990s the very first company to be licenced by the government to provide internet services in India.

It is a technology company that is publicly listed, and also has a prior track record over two decades of many rounds of funding of venture capital, private equity, and debt, from both domestic and international investors and lenders. These have included many prominent global institutional investors, as well as niche ones focusing on specific sectors, with investment arms spread across a large number of international jurisdictions. This is a matter of record, which you can verify, rather than take out of context any one such investment from a particular jurisdiction.

The transactions you refer to include those which are well over two decades old. To the best of my knowledge, they met the prevailing regulatory norms and had the requisite approvals. With regard to your questions on share prices, volatility is a rather common occurrence in the technology sector, especially in small startups which can take a long time to earn returns, as was the case in this instance. Even after this company went public, its share prices have had large fluctuations, sometimes within the same year. You can verify from trading records that they have varied from a high of more than Rs. 200 to a low of less than Rs. 5, especially after the disruptions in the telecoms sector in the past three years.

Different investors have different risk appetites, as well as different time horizons. Our family holdings have both benefited from buying shares at low prices and seeing them rise sharply, as well as the opposite. This you can verify from examining the entire panoply of transactions over the years, which have included significant losses incurred from investments in this company as well. Rest assured, such gains and losses were not a result of malfeasance, but a result of calculated risks by those who have been managing these investments, some of which paid off and others which failed.”

FULL RESPONSE OF MANJULA DEVI SHROFF

“I am completely taken aback by your email. I am not aware of any complaint to SIT as you claim, nor find any reason as to why I should come within the purview of SIT. It appears that the complainant that you mention wishes to use me for an ulterior motive, political or otherwise.

Most Read 1Leo box office collection Day 3 early reports: Vijay’s film bounces back, records 10% spike in earnings 2AR Rahman ‘totally changed’ after embracing new faith, changing name from Dilip Kumar: Sivamani 3Leo box office collection Day 3: Thalapathy Vijay-starrer leaps past Rs 200 crore global gross in three days, is already the 7th-biggest Tamil film ever 410 yrs on, a letter Captain Amarinder Singh wrote to Sonia Gandhi comes back to haunt Pratap Singh Bajwa in House 5Raj Kundra pens note about next phase of his journey: ‘It’s time to separate now’

As a power of attorney holder, I have had no control over the entities that you mention nor have I been the beneficiary of any of the transactions suggested by you.

I take this opportunity to deny the surmises and allegations made in your email, as also the premise thereof.

Also ReadIE100: The list of most powerful Indians in 2021Drug menace bigger threat than militancy, we’re going Punjab way: J&K DGP…Since 2014, 4-fold jump in ED cases against politicians; 95% are from Opp…Videocon gets Rs 3250-crore loan from ICICI Bank, bank CEO's husband gets…

I trust that as a responsible publication, any reporting that you/Indian Express may do in this regard, will ensure that my unblemished reputation built over the years in not in any way tarnished.”