Union Budget 2018: The government said the first year of implementation of GST has resulted in a large amount of unsettled Integrated GST money.

Union Budget 2018: The government said the first year of implementation of GST has resulted in a large amount of unsettled Integrated GST money.

With the government accounting for 11 months of revenues under GST for 2017-18, it said it would face a shortfall of Rs 50,000 crore in revenue under the indirect tax regime in the current financial year. The government has pegged GST revenue for the current financial year at Rs 4.45 lakh crore, and for 2018-19 at Rs 7.44 lakh crore.

“The shortfall (as against the revenue department’s calculation) in GST collection is Rs 50,000 crore for the current fiscal,” finance secretary Hasmukh Adhia said.

Also read | Breaking down the Budget in 20 questions

The government said the first year of implementation of GST has resulted in a large amount of unsettled Integrated GST money. IGST receipts are estimated at about Rs 1.62 lakh crore in the revised estimates of 2017-18 and “will be divided between the Centre and the states on an equitable manner similar to the pattern of devolution of taxes” that is being undertaken by the government, the Budget said.

The introduction of the new taxation regime has impacted the revenue position of the government also because of structural issues. Finance Minister Arun Jaitley said the 11-month revenue from GST will have “fiscal effect” along with some shortfall in non-tax revenues on account of certain developments, including deferment of spectrum auction, though a part of this shortfall has been made up through higher direct tax revenues and bigger disinvestment receipts.

Read | Beyond pink covers for Economic Survey, little on offer for women, say experts

Under the new GST regime, the last date for filing of GST returns remains the 20th of the succeeding month even on the last day of the financial year. This means that the tax receipts during the current year was only for 11 months, excluding the indirect tax receipts for March. This spillover will result an estimated loss to the central government’s tax kitty to the tune of between Rs 35-36,000 crore, the Budget said. “This one-time impact on the Central Government’s fiscal will lead to a temporary and onetime spike in the fiscal deficit over and above the estimated fiscal deficit during the previous budget,” it said.

Most Read 1Tiger 3 box office collection Day 2 early reports: Salman Khan film will aim to go on an overdrive with more than Rs 80 cr all-India nett 2Tiger 3 box office collection day 1: Salman Khan gets biggest opening of his career as film braves Diwali day to record Rs 94 cr earning 3Abhinav Bindra’s rousing pep talk for India ahead of World Cup semifinal against New Zealand: ‘Crisis? That’s just another word for I’m about to make history’ 4Leo box office collection day 24: Vijay starrer nears the end of its theatrical run, Rajinikanth’s Jailer record may still be out of reach 5Who is Imran Chaudhri, the man dreaming of replacing your smartphone with a tiny AI wearable?

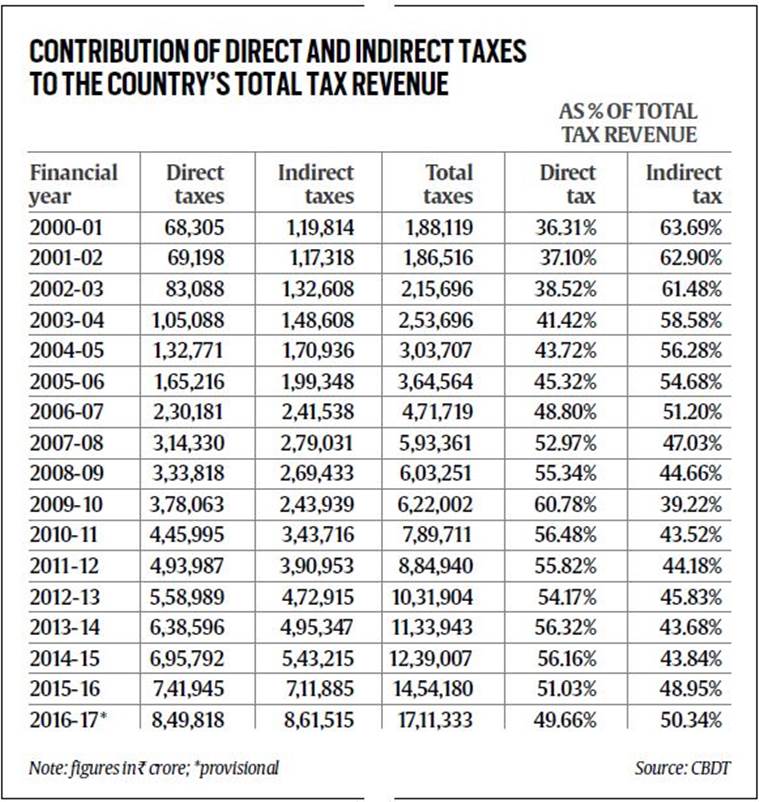

The total revenue from indirect taxes (excise, customs and GST) in 2018-19 has been pegged at Rs 11.16 lakh crore, while from direct taxes has been estimated at Rs 11.50 lakh crore. For 2017-18, Rs 9,36,375 crore estimated to be collected from indirect taxes (excise, customs, service tax and GST). As per revised estimates for 2017-18, collections from direct taxes have been estimated at Rs 10.05 lakh crore, higher than the budget estimate of Rs 9.80 lakh crore.

GSTN gets 4-year breather on service tax

The government announced a special provision for exemption from service tax in respect of taxable services provided or agreed to be provided by the Goods and Services Tax Network (GSTN), retrospectively. The government in Budget for 2018-19 exempted GSTN, the IT backbone of GST, from service tax payment in respect of taxable services from March 28, 2013 to June 30, 2017. Retrospective refund of all such service tax that has been collected, but would not have been so collected, has also been allowed, provided that an application for the refund claim is made by GSTN within a period of six months from the date on which the Finance Bill, 2018, receives the President’s assent.

Also ReadUnion Budget 2023 income tax slabs: New tax regime is default, rebate inc…Union Budget 2023-24: Education outlay hiked 8%, PM-Poshan gets 13% moreRail Budget 2016: Baby foods, hot milk, hot water to be available, says S…A large chunk of spending: Rs 51,971 cr just to settle Air India debt bef…

Last year, the GSTN had come under scrutiny from the service tax department, with the Office of the Principal Commissioner of Service Tax, Delhi-I, having even summoned GSTN’s CEO Prakash Kumar, in a notice dated February 11, asking him or an authorised representative to produce documents and records for the investigation.