Amid the efforts to cut dependence on China-centric global supply chains, countries such as Vietnam have grabbed the China+1 headlines more than India. However, the announcement at the G20 Leaders’ Summit on the landmark India-Middle East-Europe Economic Corridor (IMEC) has the potential to make India an Asian hub in global supply chains.

Prime Minister Narendra Modi’s visit to Washington DC in June showed that supply chains are at the centre of the latest chapter in India-United States relations.

First, what are supply chains?

Supply chains — variously described as global production networks, production fragmentation, or global value chains — refer to the geographical location of stages of production (such as design, production, assembly, marketing, and service activities) in a cost-effective manner.

Global supply chains have been the leading model of industrial production since the 1980s, influencing the pace and nature of globalisation and regionalisation. The shift in industrial production from local and regional supply to global supply took place gradually over the last 100 years.

Global supply chains can be found in a wide range of simple (textiles and clothing, food processing and consumer goods, etc.) and complex industries (e.g., automotives, aircraft, machinery, electronics and pharmaceuticals).

Best of ExplainedWomen's reservation: Seeds of the idea under Rajiv Gandhi and Narasimha Rao govtsWho was Hardeep Singh Nijjar, the Khalistani separatist that Canada PM Trudeau says India may have got killedBima Sugam: Is it a ‘UPI moment’ for insurance sector, and how will it benefit customers?Click here for more

Why are global supply chains moving from China?

Even before the Covid-19 pandemic, Western firms had begun to reduce their reliance on China, and its popularity as a sourcing market among Western buyers was diminishing. Some production stages in Chinese supply chains, particularly the labour-intensive ones, were moving to lower-cost locations. The trend was attributable in part to rising wages and supply chain bottlenecks within China, and investor concerns about tighter regulation of foreign firms.

The global risks of supply chains concentrated in mainland China and Hong Kong are underlined by recent data. Exports from the two markets, which together represent 20% of world exports of intermediate goods, decreased 15% and 27% year-on-year respectively during the last quarter of 2022. Shipments from the US, which accounted for 8.1% of world exports of intermediate goods, fell by 3% while those of Japan, with 4% share, fell by 13%.

Also Read | Foreign companies are shifting investment out of China as confidence wanes, says business group

The downturn, coupled with internal risks in China and the country’s trade war with the US, is forcing multinational companies to rethink their global sourcing strategies.

It is costly to shift supply chains — new plants need to be set up, and workers need to be hired and trained, which makes it difficult to relocate production from China wholesale. Even so, considerations of profitability are influencing a trend of relocating production either to friendly countries or back to the US.

Why is India being considered an attractive supply chain hub?

Southeast Asia has beckoned foreign companies with cheap wages, fiscal incentives and improved logistics. Vietnam and Thailand are big winners in supply-chain shifting. But over time, India can become a complementary Asian manufacturing hub to China by reaping gains from foreign technology transfers and creating value-adding jobs.

This is seen in the ramped-up manufacturing of iPhones in the country, early technology transfer in the product cycle of the technologically advanced Mercedes Benz EQS to India, and Foxconn Technology Group developing a chip-making fabrication plant in Gujarat. Manufacturing sectors in India such as automotives, pharmaceuticals, and electronics assembly are already sophisticated, and likely to emerge as winners in this race.

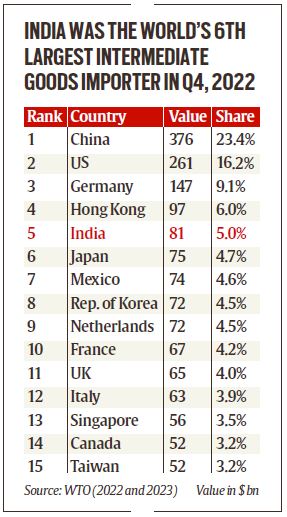

India’s attractiveness to foreign investors is also linked to geopolitical and economic factors. The World Trade Organisation (WTO) lists India as the fifth largest importer of intermediate goods in 2022 Q4 with a 5% share, suggesting that supply chain pessimism on India may be altering since the pandemic.

Explained | Why Indian manufacturing’s productivity growth is plummeting and what can be done

The countries ahead of India are China (23.4%), the US (16.2%), Germany (9.1%), and Hong Kong (6.0%). India could in the future double its current 1.5% share of world exports of intermediate goods.

Indian service can also be a winner, including in information and communications technology, back-office work, financial and professional services, and transport and logistics.

Since 2022, the Narendra Modi government’s trade policy has placed renewed emphasis on preferential trade through a flurry of bilateral deals with trading partners.

The UAE-India Comprehensive Economic Partnership Agreement entered into force in May 2022. An early harvest was reached in April 2022 for the Australia-India free trade agreement (FTA), and talks are ongoing to conclude the full FTA by the end of 2023. Negotiations for a UK-India and EU-India FTA are in process.

These new deals are significant because they are with Western trading partners, and reflect plans for deep economic integration going well beyond India’s previous FTAs which focused solely on the goods trade and related measures.

So, what must India do going forward?

India can learn much from China’s experience.

First, the promotion of export-oriented foreign direct investment (FDI) is key to participating in supply chains. A gradual stance of trade liberalisation dictates maintaining an open-door policy toward FDI in manufacturing and facilitating investment at a high level, with competitive fiscal incentives and the creation of modern special economic zones as public-private partnerships. The reduction of business hassles through digitalisation of tax, customs, and business administration, and high-quality free trade deals is essential.Second, local companies need smart business strategies to join global supply chains. Big companies naturally have advantages in supply chains due to the larger scale of production, better access to foreign technology, and the ability to spend more on marketing.

Conglomerates can cross-subsidise investments and other costs among business units. Small and mid-sized enterprises should, therefore, work as industrial suppliers and subcontractors to large exporters.

Business strategies like mergers, acquisitions, and alliances with multinationals and large local business houses are rational approaches. So is investment in domestic technological capabilities to achieve international standards of price, quality, and delivery.

Third, caution should be exercised before India attempts to replicate China’s state interventionist template wholesale, as there is a significant risk of government failure and cronyism. It may be prudent to actively engage with think tanks to gain insights into what might work.

Still, some aspects of China’s industrial policy may be relevant to India, including better targeting of multinationals in new industrial activities in which there may be a potential comparative advantage and better coordination between the central and state governments. Equally important is upstream investment in tertiary-level education in science, technology, engineering, and mathematics.

Could the South Asian region as a whole benefit from this approach?

India has a historic opportunity to promote industrialisation in South Asia, which would stabilise the region, increase jobs, and make it less vulnerable to Chinese enticements.

Market-led spillovers from India’s supply chains through outward-foreign investment in labour-intensive manufacturing are a natural transmission channel to Bangladesh and Sri Lanka.

India’s dynamic start-up culture, venture capital financing and fintech capacity can be used to draw in young entrepreneurs from other South Asian countries.

The Indian government should consider two policy initiatives to promote regional supply chains.

First, upscaling the Make in India Programme into a Make in South Asia Programme. India can provide fiscal incentives to Indian manufacturers to expand into Bangladesh and Sri Lanka, which are in apparel supply chains. Food processing, textiles and apparel, and the automotive sector might be candidates for this, given India’s neighbours’ factor endowments and industrial experience.

Second, India should conclude a comprehensive bilateral FTA with Bangladesh and upgrade the Indo-Sri Lanka FTA to support regional rules-based trade and investment.

Most Read 1Chandrayaan-3 mission: Dawn breaks on Moon, all eyes on lander, rover to wake up 2As Indo-Canadian relations sour, anxiety grips Indian students, residents who wish to settle in Canada 3Karan Johar says Sanjay Leela Bhansali did not call him after Rocky Aur Rani: ‘He’s never called me but…’ 4Gadar 2 box office collection day 40: Hit by Shah Rukh Khan’s Jawan onslaught, Sunny Deol movie ends BO run with Rs 45 lakh earning 5Shubh’s tour in India cancelled: Why is the Canada-based singer facing the music?

These initiatives can help to integrate these two countries into supply chain activities centred on India as the assembly hub, and bring mutual welfare gains in terms of industrialisation, real income growth and job creation.

Unless India creates channels for South Asia, it has no offer for the Global South. The fresh supply chains opening up with the US are a good place for India to start its global integration journey, Neighborhood First.

Also ReadSensex, Nifty dip by 1%: What has triggered this sell-off?Bima Sugam: Is it a ‘UPI moment’ for insurance sector, and how will it be…EV subsidies: Will EU-China row lead to a tariffs war?How Basmati in India is reaping the rewards of research

Dr Ganeshan Wignaraja is Professorial Fellow in Economics and Trade at Gateway House: Indian Council on Global Relations, Mumbai. He is the author of the paper, ‘The Great Supply Chain Shift from China to South Asia?’

© The Indian Express (P) Ltd