The first payments bank in India, Airtel Payments Bank, reported deposits of Rs. 68.33 crore at the end of the financial year 2016-17, which was its first year of operation

The first payments bank in India, Airtel Payments Bank, reported deposits of Rs. 68.33 crore at the end of the financial year 2016-17, which was its first year of operation

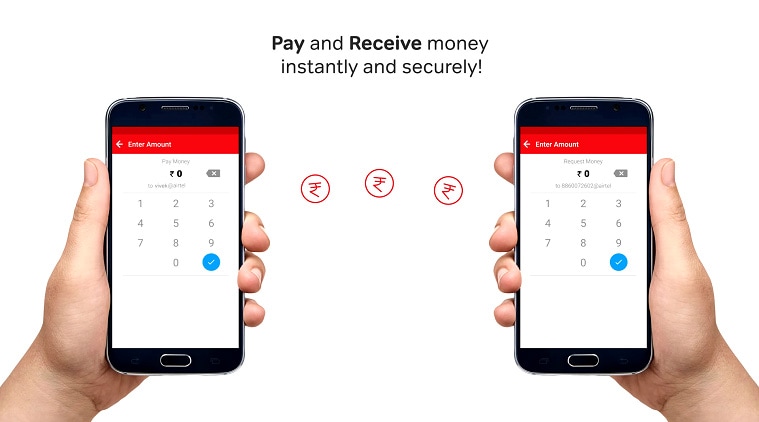

UPI has been trending for some time now. It is low-cost, cashless, and provides an unmatched payment experience with complete financial security. For the uninitiated, UPI or United Payments Interface helps you transfer money and make payments using the IMPS (Immediate Payment Service). It is akin to a social media username or an email id for all your financial needs. Usually, transferring money online requires a bank account number, account holder’s name, and the IFSC code. Typing all of this is cumbersome. Moreover, with most banks, you have to register the beneficiary first (which generally takes hours) before transferring any amount. Doing all this takes a lot of time and seems like a chore. UPI makes it exponentially simple and effortless.

It allows you to instantly send and receive money from your smartphone using virtual payment address, without entering bank account details such as IFSC code and account number. With this concept in mind, a lot of key players in the field of technology and communication have forayed into banking through UPI. These payment banks provide a lot of facilities that regular banks don’t. For example, there is generally no minimum balance required. The interest rates are highest in the industry, and the user can also avail an online debit card that can be used to transact anywhere online.

Payments banks are rapidly gaining acceptance. This is evident from the expanding user base. The first payments bank in India, Airtel Payments Bank, reported deposits of Rs. 68.33 crore at the end of the financial year 2016-17, which was its first year of operation! But even after all this, an important question arises: Is your money secure? The answer can be summarized in a single word. Yes.

Most Read 1Chandrayaan-3 mission: Dawn breaks on Moon, all eyes on lander, rover to wake up 2As Indo-Canadian relations sour, anxiety grips Indian students, residents who wish to settle in Canada 3Karan Johar says Sanjay Leela Bhansali did not call him after Rocky Aur Rani: ‘He’s never called me but…’ 4Gadar 2 box office collection day 40: Hit by Shah Rukh Khan’s Jawan onslaught, Sunny Deol movie ends BO run with Rs 45 lakh earning 5Shubh’s tour in India cancelled: Why is the Canada-based singer facing the music?

Airtel Payments bank is as secure as any other bank. First, your bank account is on your smartphone. Secondly, it can be secured by your smartphone’s password or via the fingerprint sensor. And thirdly, all the transactions are electronically encrypted. UPI also enables one to use QR codes, which is a secure encryption in itself.

So, rest easy and open an account with Airtel Payments bank if you haven’t already. It takes less than three minutes and requires nothing more than your Aadhaar card and hundred rupees. Also, there are a lot of benefits to avail.

Also ReadRedefining ‘PerfectSelfie’ with Huawei Nova 3iPlanning to buy a flagship phone? This comparison between OnePlus 6T and …LeEco chairman YT Jia believes India’s user value will surpass ChinaPlanning to buy a mid-range smartphone? Honor 9N is the notched beauty yo…

An Airtel Payments Bank savings account earns you an interest of 7.25% on every rupee you save while giving a free personal accident insurance cover of Rs.1 lakh. It has a network of 25 million bank customers, who can now use Airtel Payments Bank UPI for both online and offline transactions.

Click here to know more about Airtel Payments Bank.